Managing my budget is easy if I stick to it.

I heard so many people talk about how they are so bad at managing money. There are a lot talk about how people use the “Envelope Method” or “Cash Stuffing” an individual literally have cash in an envelope. This is a great starting point but a lot of the time I may not know how much money to put in there.

This is not financial advise. This information is how I manage my money with my net income.

What’s Net Income in my case: After taxes

JAR Money Management System

Back in 2010 my little brother showed me this method called the Jar Money Management System. By T Harv Eker. It’s a very simple system that just made a lot of sense to me.

The idea is to have a hypothetical 6 Jars of cash. Each of them is for a very specific category.

- Necessities - Rent/Mortgage, Food, Clothing

- Financial Freedom - Investments on things that’ll make me money.

- Education - Money that I use for classes, courses, coaching, etc.

- Long Term Savings - Saving for something big like a Car, Home, Vacation, etc.

- Play - Money for immediate personal enjoyment

- Give - For charitable things, birthday gifts, Christmas Gifts, etc.

The fundamental amount to split each one is

55% in Necessities

10% in Financial Freedom, Education, Long Term Savings, and Play

5% in Give

This is a foundation and not the rule.

I can have it very differently especially if my Necessities is a lot higher than 55% of my monthly income. It could even be 95% of my income.

The point is to start splitting the money in separate categories.

List out Necessities

When starting out the money management, I want to start writing down all my necessities in actual writing. I also question if they are necessities or not. Is my phone bill a necessity? Is my internet a necessity? Is Netflix subscription a necessity?

To me phone and internet can counts towards necessity but a Netflix subscription isn’t. I don’t need Netflix but I sure need phone and internet these days.

After writing down that list, check monthly statement for each one. I then written it down next to each of them.

Add the total and that is how much I need to put into my necessity list. I include some wiggle room (maybe 10% more) because this is the first month of doing it. Who knows if I need extra money for food or other expenses that I didn’t think about.

Managing the rest of the money

Let’s say that was 80% of my income. That would be (to make it easier) 4.5% each. Realistically it would be 4.44%. Then I calculate income based around that and make the Give half of that which is 2%.

You might be thinking. 2%? That’s nothing. Unfortunately that’s going to have to be the case unless I increase my income or lower my necessity in some way.

Hypothetical income

Lets say I make $2500.00 a month.

80% of my income is a necessity. That is $2000.

4.5% of the income would mean $112.50 and do that 4 times for the other accounts.

2% of that would be $50.00 for giving.

What is I don’t care about spending $112.50 to have fun. What if I only need $70. I can put the $42.50 else where. I can either split that again or dump it all in my investments.

After 3 months

I would know that I don’t need to put in 80% of my money into necessities. It will likely be less than that because I did add some wiggle room on how much I need. What if that became 75% Then once again, I use my best judgement on how much I want to put in each of the other accounts.

Sticking to it without breaking the rule

The important point I want to make is, it is very important to stick to this money management at least for a year. Saying “A little bit of rule breaking” doesn’t hurt. That is the little snowflake that can turn into a big snowball. If I go off course and continue expanding out the rule that I am no longer following the rule at all.

I would at the very least put in $1.00 for each accounts.

I will also emphasis that I like to write this down in a physical hand written ledger. The way I like to do it is the Kakeibo method.

Money management in real life to Video Games.

The easiest way I can think of benefit when it comes to video games are MMO and other live service games.

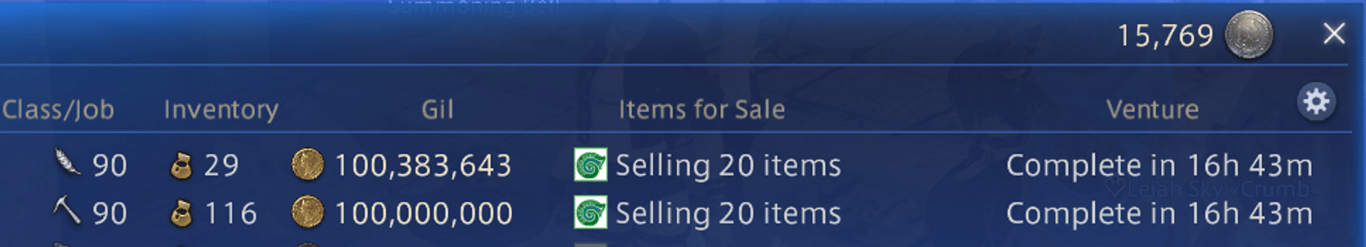

I play Final Fantasy XIV and you are allowed to have 2 to 9 retainers which are helpers who sell things for you and hold your items and money.

I use this method in the game except parts that does not make sense like. I don’t need education funds since there’s nothing to pay with in game currency to learn about anything anyways.

You can also do this with other MMOs like World of Warcraft but you may need to keep notes on that since you only really have one bank and your inventory to keep track.